Bitcoin Vs Dot Com Bubble Chart

- Get link

- X

- Other Apps

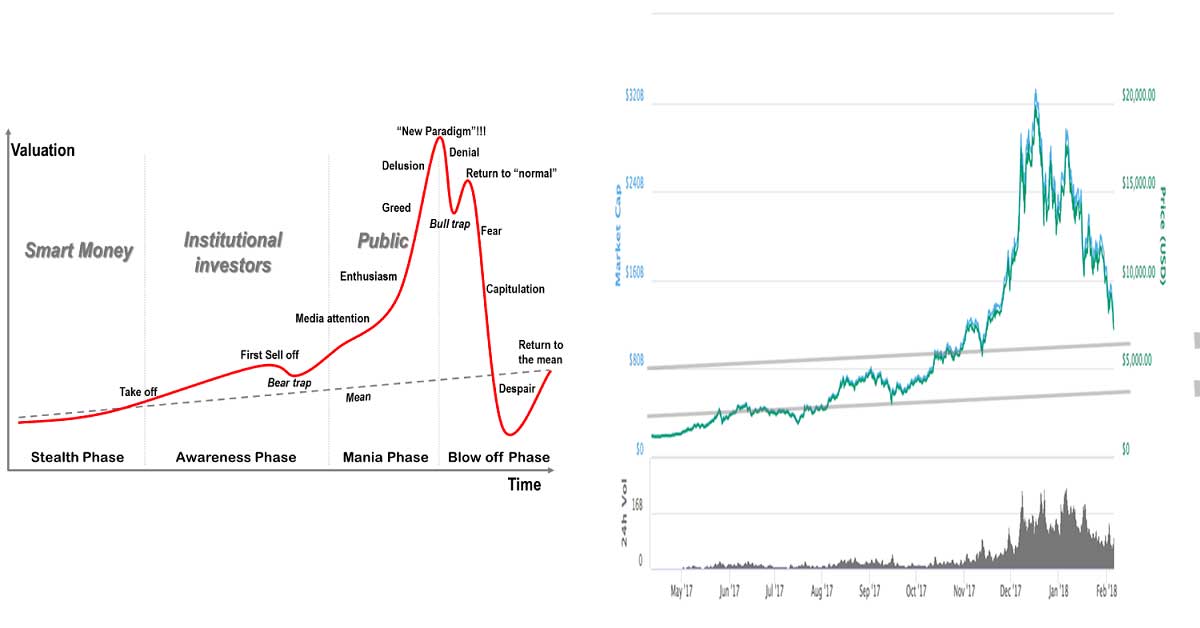

Bitcoin Vs Dot Com Bubble Chart. At the beginning of 2015, bitcoin was trading just above $300. Countries that accept litecoin dotcom bubble cryptocurrency, bitcoin vs the dot com bubble are the comparisons a bad thing, look how bitcoins rise stacks up against the internet, bitcoins bubble cycle more bullish than amazons dot com, bitcoins nearly five fold climb in 2017 looks very similar.

Also known as the internet bubble, the dotcom bubble was a frenzy in the late 1990s in which technology stocks saw a rapid rise in value on the market.

The charts shared demonstrate that human psychology rarely changes, and thus, markets typically behave in similar manners. In early november this year, the bitcoin price topped $7 from a valuation perspective, visa is valued at only $6 per transaction while bitcoin trades well over $10,000 per transaction (see the chart below). The investment firm in a note said the cryptocurrencys price chart is largely mirroring that of the nasdaq composite index during the dot com bubble. The first factor is that the metrics used at the time did not take cash flow into account.

- Get link

- X

- Other Apps

Comments

Post a Comment